Is SoFi a good bank in 2025? For your needs? Learn everything about SoFi’s features, physical locations, Zelle support, account closure process, and how it compares to TD Bank, Ally, and CIT.

Is SoFi a good bank in 2025?

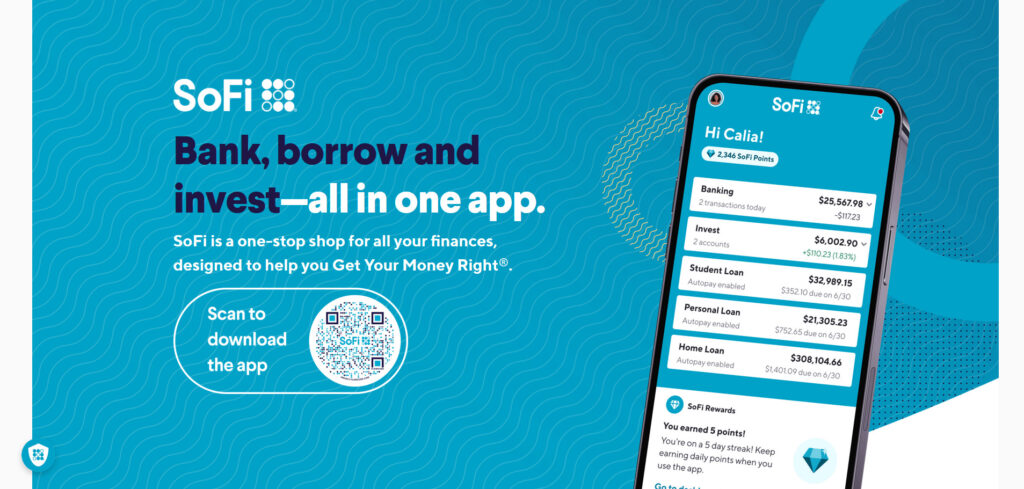

Choosing the right bank goes beyond interest rates—it’s about trust, convenience, and how well a financial institution fits your lifestyle. Whether you value sleek mobile apps, no-fee banking, or integrated financial tools, digital banks like SoFi are changing the way people manage money. SoFi has been gaining attention for offering a streamlined, all-in-one platform with checking, savings, investing, and loan options. But is SoFi a good bank for your specific needs?

In this post, we’ll break down SoFi’s core banking features, compare it with popular competitors, explore its compatibility with services like Zelle, and explain how to manage or close your account.

In this post, we’ll uncover the key advantages and potential drawbacks of banking with SoFi. You’ll also find insights on how SoFi compares with competitors and its support for services like Zelle, plus whether physical locations exist and how to close an account.

👉 Explore more:

- Sofi vs TD Bank

- CIT Bank vs SoFi

- SoFi vs Ally Bank

- SoFi Bank and Zelle

- Closing a SoFi Account

- SoFi Locations

What Makes SoFi a Good Bank?

SoFi stands out as a modern financial institution built entirely online. With zero monthly fees, high-yield savings accounts, and early direct deposit, it’s tailored for the digitally savvy.

Pros and Cons of SoFi Bank

| Pros | Cons |

|---|---|

| No monthly fees or overdraft charges | No physical bank branches |

| High APY on savings accounts | No in-person customer service |

| Free budgeting tools and credit score monitoring | Limited options for cash deposits |

| Early direct deposit availability | Not compatible with Zelle |

| Integrated platform for banking, loans, and investing | Some users may prefer traditional banking services |

| Access to 55,000+ fee-free ATMs via the Allpoint® network | Live support may not be as responsive as traditional banks |

Sofi vs TD Bank

When comparing SoFi vs TD Bank, the primary difference lies in accessibility vs tradition. SoFi offers fully digital banking with no fees and high APY savings. In contrast, TD Bank provides brick-and-mortar access and more traditional customer service, but with typical banking fees.

✅ Choose SoFi if you want digital-first banking with higher yields.

🏦 Choose TD Bank if you prioritize in-person service and cash deposits.

CIT Bank vs SoFi

Both CIT Bank and SoFi offer strong online banking experiences. However, CIT Bank leans toward high-yield savings and CDs, while SoFi provides an all-in-one app with credit building, lending, and investing features.

Key Differences:

- SoFi offers more diverse financial services

- CIT often has slightly higher APYs for savings

- Neither has physical branches

SoFi vs Ally Bank

In the SoFi vs Ally Bank debate, both are solid options for digital banking. Ally is known for customer satisfaction and 24/7 support, while SoFi appeals to younger users with student loan refinancing, investing, and a slick mobile experience.

SoFi Bank vs Ally Bank boils down to what matters more:

- Investing & loans (SoFi)

- User-friendly banking and CDs (Ally)

Does SoFi Bank Use Zelle?

One common question: Does SoFi Bank have Zelle? Currently, SoFi does not natively support Zelle, which may be a dealbreaker for some users.

You can still send money via SoFi using their P2P system, or link external accounts with Zelle access — but the integration isn’t seamless.

So to clarify:

- ✅ Does SoFi Bank use Zelle? – No

- ❓ Does SoFi Bank have Zelle built-in? – Also no

How to Close a SoFi Bank Account

Need to switch banks? Here’s how to close a SoFi Bank account:

- Transfer all funds out

- Cancel direct deposits or linked bills

- Contact customer support via the SoFi app

- Request account closure confirmation by email

⚠️ Make sure your account is fully settled before requesting closure.

Does SoFi Bank Have Physical Locations?

No, SoFi does not have physical bank branches. It’s a completely digital bank, operating entirely online or via mobile app. This helps eliminate many fees but may feel limiting for users who want in-person banking services.

SoFi Bank Locations in the USA

There are no traditional SoFi Bank locations in the USA. However, SoFi members can access 55,000+ fee-free ATMs via the Allpoint® network across the country.

📍 The ATM locator is available in-app for your convenience.

Final Verdict: Is SoFi a Good Bank?

✅ Yes — for the right customer.

If you’re comfortable with mobile banking and want a fee-free, high-yield, all-in-one financial app, SoFi is a strong contender. But if you rely on in-person service or Zelle, you might find it lacking.

FAQs

🔹 Does SoFi use Zelle?

🔹 How do I close my SoFi account?

🔹 Where is SoFi Bank located?